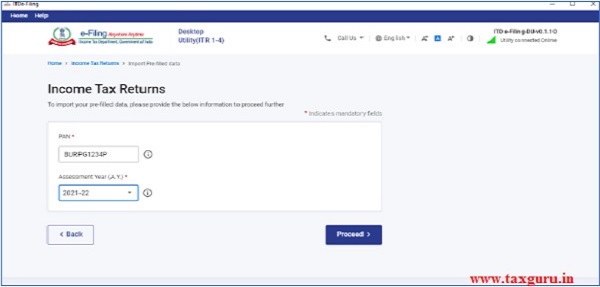

Augmenting simplicity and removing impediments will go a long way in increasing compliance and facilitating good governance," Malhotra added. The government's efforts, to build a favourable tax regime for taxpayers cannot be disregarded. “The utility itself provides help in the form of FAQs, guidance notes, circulars and provisions of the law so as to enable hassle-free return filing. Nangia Andersen India Director Neha Malhotra told news agency PTI, the new utility is a user-friendly functionality for filing of returns and will afford greater ease to the taxpayers. Through the offline utility, taxpayers shall have to download the pre-filled data from the income tax e-filing portal and import the same on the new utility, which enables users to edit and save returns, pre-filled data and profile data.

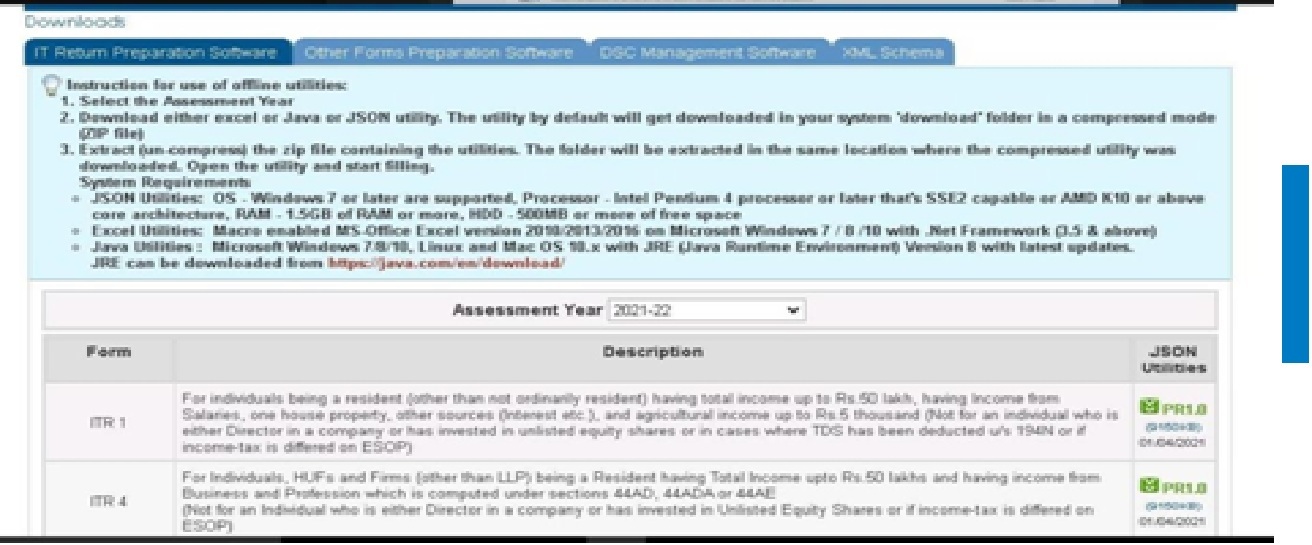

“Once filing is enabled, you can upload the same at e-filing portal," the I-T department added. Since the facility to upload ITR at the e-filing portal is not yet enabled, filers can fill and save the offline utility. I-T return filers can import and pre-fill the data from e-filing portal and can also fill the remaining data. ITR-4 can be filed by individuals, Hindu Undivided Families (HUFs) and firms with total income up to ₹50 lakh and having income from business and profession. Sahaj can be filed by an individual having income up to ₹50 lakh and who receives income from salary, one house property / other sources (interest etc). ITR Form 1 (Sahaj) and ITR Form 4 (Sugam) are simpler forms that cater to a large number of small and medium taxpayers. Other ITRs will be added in the utility in subsequent releases," the department said, while releasing the step-by-step guide for its filing. “This Offline Utility is enabled only for ITR-1 and ITR-4. The offline utility can be downloaded on computers with operating system Windows 7 or later versions.

0 kommentar(er)

0 kommentar(er)